How Asia Is Moving to a Cashless and Contactless Lifestyle

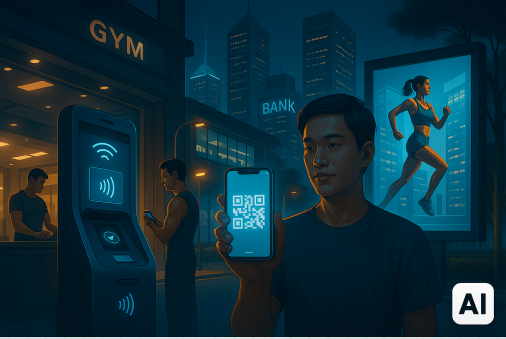

Asia is on the fast track to becoming the world’s leading cashless and touchless economy. In countries like China, India, and Singapore, mobile wallets, QR codes, and instant payment apps are popping up everywhere. Thanks to growing cities, cheap smartphones, and friendly government rules, this shift is changing how people shop, travel, or pay bills.

The tech was already there; the pandemic just made everyone go touch-free faster. Now, whether you’re buying noodles from a street vendor or browsing at a luxury mall, a contactless method is usually waiting. And it isn’t just city dwellers: simple fintech apps in local languages are bringing villages into the loop. Sports arenas, gyms, and even small dojos now rely on mobile payments too.

The Role of Governments and Super Apps

Governments in Asia have been important in facilitating digital payments by providing regulatory support and innovation frameworks. The Chinese government promotes such super apps as Alipay and WeChat Pay that integrate e-commerce, banking, and health-related tracking. UPI (Unified Payments Interface) is a national real-time payment system in India, which is connected to banks and digital wallets.

In 2023, UPI in India made more than 10 billion transactions in one month. This wider context has seen the integration of services such as MelBet promo code into everyday use of apps, as opposed to the isolated platforms. Local startups in Indonesia and Vietnam are working on the creation of cashless ecosystems similar to the Chinese one.

The change has resulted in collaborations between legacy banks and fintech startups. Neighborhood shops and small gyms and fitness studios have also started accepting QR payments through Paytm, GCash, or GoPay. In Pakistan, adoption is increasing with Raast system by the State Bank, which is aimed at consumers and micro-enterprises.

Table: Popular Payment Platforms by Country

| Country | Leading Platform(s) | Notable Feature |

| China | Alipay, WeChat Pay | Super app integration |

| India | UPI, PhonePe, Paytm | Real-time, interoperable payments |

| South Korea | Kakao Pay, Naver Pay | App ecosystem for lifestyle and media |

| Indonesia | GoPay, OVO | Ride-hailing + payments |

| Vietnam | MoMo, ZaloPay | Gamification and rewards |

| Singapore | PayNow, GrabPay | Linked to NRIC and bank accounts |

| Pakistan | Easypaisa, JazzCash | National ID integration |

Beyond Payments: A New Lifestyle Model

Its easy to see why athletes and event planners love digital wallets. Day-to-day money moves stay crystal-clear, payouts hit freelancers in seconds, and ticket tapes never vanish in a cash pocket. Fewer handoffs also mean less chance of catching a virus for anyone already glued to a screen.

Many fitness brands reward patrons with loyalty points, in-game giveaways, or early access to rare gear. South Korea and Japan pair their AR gym apps with smart bands and monthly fees so runners can measure strides while buying a new pair of shoes from inside the program. Serious athletes track speed, scan a bar code, and swipe for custom lessons on the same phone.

Japan’s no-touch vending kiosks, which read faces or an NFC card, even made a test run inside the Tokyo Olympic Village. Over in India, smartwatch lockers on running lanes rent out shoes or bottles through a single tap, and Singapore stadiums have gone fully cashless thanks to prepaid RFID wristbands that act as both ticket and snack fund.

Benefits and Growing Pains

The shift to digital isn’t just about moving money; it’s about changing how we play, train, and unwind. Across Indonesia, gamers and football lovers are using local apps linked to MelBet Indonesia to pay tiny fees for memberships and team gear. Touch-free gym cards, ticketing that lives right on your phone, and virtual league play are now the everyday ways fans and athletes connect.

Of course, progress never arrives without a few bumps. Many villages still struggle with weak signals and limited know-how, which leaves some people locked out. Privacy worries linger, too, especially when payment scans use fingerprints or when firms trade user data. The recent 2023 hack of a major Thai e-wallet only underscores why tighter rules, quick response teams, and strong codes must follow every new feature.

In response, governments are rolling out tougher data laws side by side with in-language classes that break down digital tools. Singapore’s Digital Readiness Blueprint, for example, bundles step-by-step training on e-payments with walk-in help. Meanwhile, India’s Digital Seva centers offer hands-on support so people can move confidently into a cash-light future, whether they’re paying a bus fare or booking a stadium seat.

Use Cases of Cashless Innovation in Sports & Lifestyle

- App-based gym memberships with auto-renewal via wallets.

- QR code ticketing for stadium events and local leagues.

- Virtual sports tournaments with digital entry fees.

- Wearable integration for contactless purchases mid-race.

- NFC payment-enabled lockers at sports complexes.

- Subscription-based fitness video content with UPI support.

What Lies Ahead for Asia’s Cashless Future?

The competition to eliminate friction on day-to-day transactions is continuing. In South Korea, ID systems based on blockchain are appearing, which connect wallets to validated health and academic data. In India, safer app payments are getting popular with tokenized credit cards. In the meantime, China is already running the e-CNY (digital yuan) at sporting events and transport terminals.

Firms are developing biometrics-based systems, either on the retina, face, or fingerprints, that can do away with phones altogether. Protein drinks and face-recognition vending systems have been used in some Japanese pilot programs to enable registered athletes to purchase a protein drink mid-training without having to touch a surface.

In Asia, the digital future of cashless is not only about being digital but also intelligent. Smart systems can provide spending recommendations, workout targets, and even social engagement reminders, all depending on real-time information. The combination of AI, finance, and fitness is going to become a distinctively Asian model of lifestyle in the future.